There is growing hope among private sector employees that their retirement income might finally improve. The central government is reportedly considering an increase in the minimum monthly pension provided under the Employees Pension Scheme. If approved, the minimum EPS pension could rise from ₹1,000 to ₹5,500 per month.

This potential hike, if implemented, will benefit millions of pensioners and employees covered under the Employees Provident Fund Organisation. Trade unions and employee organisations have been demanding this revision for a long time, and discussions are expected in an upcoming Central Board of Trustees meeting.

Until any official notification is issued, the proposal remains under consideration. However, it is important for employees to understand what the current rules are, how much pension is paid today and what a hike could mean for their financial future.

Current Minimum Pension Under EPS

At present, the minimum pension amount under the Employees Pension Scheme is ₹1,000 per month. This minimum was fixed in 2014, and for the past several years, pensioners have been receiving this amount without any further upward revision.

Many employees and pensioners argue that a ₹1,000 monthly pension is not sufficient to meet even basic living expenses, especially in urban areas where the cost of living is high. As prices of food, medicines, rent and utilities have increased over time, the real value of the existing pension has reduced.

Employee organisations and pensioners associations have repeatedly requested the government to revise the minimum pension to a more realistic level, with ₹5,000 to ₹6,000 often suggested as a reasonable threshold. The latest discussions on an increase to ₹5,500 fit into this long standing demand.

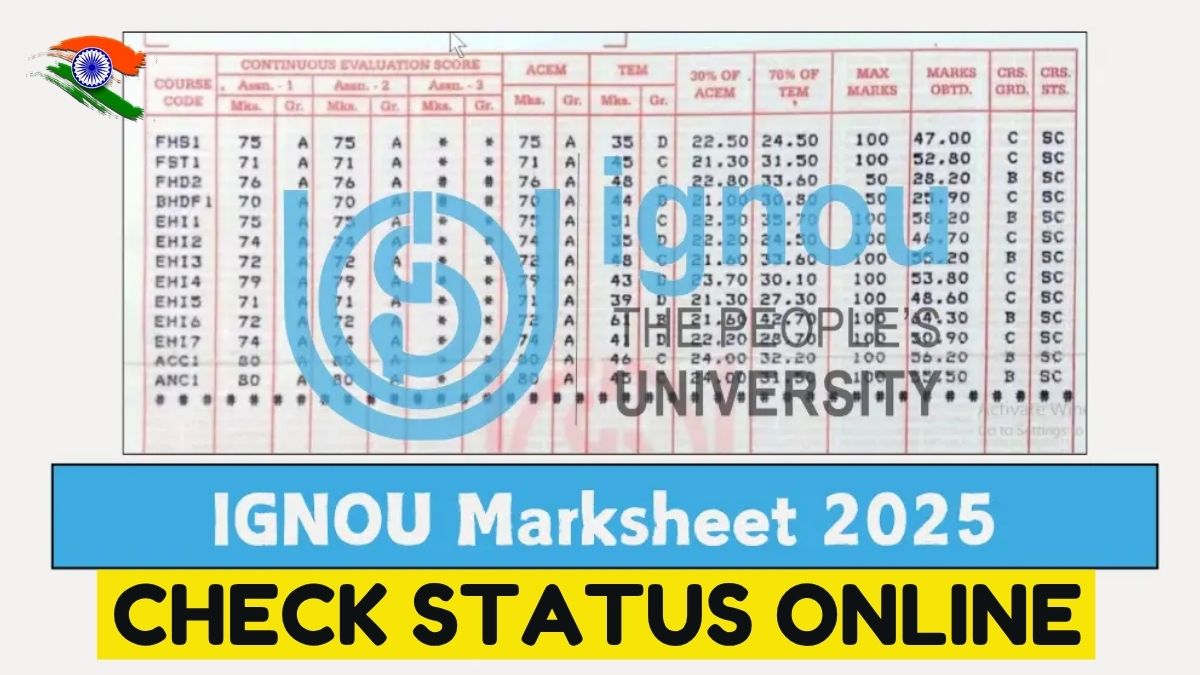

EPFO Pension Hike 2025: Quick Summary

Particulars |

Details |

|---|---|

Scheme Name |

Employees Pension Scheme (EPS) under EPFO |

Current Minimum Pension |

₹1,000 per month |

Proposed Minimum Pension (as per reports) |

₹5,500 per month |

Possible Increase |

₹4,500 per month |

Beneficiary Group |

Private sector employees covered under EPFO and EPS |

Number of EPS Pensioners (approx) |

Around 7.8 million pensioners |

Last Revision Of Minimum Pension |

Increased to ₹1,000 in the year 2014 |

Decision Authority |

Central Government and Central Board of Trustees (CBT) of EPFO |

Latest Status |

Proposal under discussion, no official notification yet |

Official Website |

Proposed Hike To ₹5,500: What Is Being Discussed

Media reports and discussions among employee groups indicate that the government is examining a proposal to raise the minimum EPS pension from ₹1,000 to ₹5,500 per month. This would mean an increase of ₹4,500 every month for those who are currently receiving the minimum amount.

Key points related to this proposed hike:

- The change would apply to pensioners who are covered under the Employees Pension Scheme.

- The decision is likely to be discussed in detail at an upcoming meeting of the Central Board of Trustees.

- If approved and notified, the new minimum pension would bring significant relief to low income pensioners.

However, it is very important to note that as of now there is no official notification confirming this new amount. Employees and pensioners should wait for a formal circular or update from EPFO or the Ministry of Labour before assuming that the hike is final.

Why Is There A Demand For Higher EPS Pension

There are several reasons why employee organisations are pressing for a higher minimum pension:

- Rising Cost Of Living

Inflation has increased the prices of food, transport, healthcare and other essentials. A monthly pension of ₹1,000 is no longer adequate to cover basic needs in most parts of the country. - Long Gap Since Last Revision

The minimum pension was last revised in 2014. More than a decade has passed without any increase in the base amount, which has eroded the real value of the pension. - Financial Security For Retirees

For many private sector workers, EPS is one of the few sources of regular income after retirement. A higher pension can provide dignity, stability and better quality of life in old age. - Repeated Representations To Government

PF employee organisations have submitted memorandums to the Ministry of Labour and Employment demanding an increase in pension. The demand has now gained wider public attention.

Which Employees Receive Pension Under EPS

Not every EPF member automatically receives a pension. To receive benefits under the Employees Pension Scheme, certain conditions must be fulfilled.

Basic Eligibility Conditions

- The employee should be a member of EPFO and EPS.

- A minimum period of eligible service is required, which generally means years of active contribution to the pension scheme through the employer.

- Pension normally starts after the age of 58, although there are separate provisions for early pension in specific cases.

Once an employee completes the required service period and reaches the eligible age, they become entitled to receive monthly pension under EPS. At present, millions of retired EPFO members are drawing pension every month under this scheme.

Role Of The Government And EPFO Interest On PF

Apart from pension, employees also receive interest on their provident fund balance. The central government declares the annual interest rate on EPF deposits every financial year.

For the financial year 2024 to 2025, the government credited interest at the rate of 8.25 percent on EPF accounts. This interest is added to the provident fund balance of employees, helping them build a larger retirement corpus.

Discussion for the next financial year’s interest rate usually begins well in advance. The interest rate decision, along with any change in pension rules, is closely watched by employees, trade unions and financial experts, as it directly affects the long term savings of private sector workers.

What A Higher EPS Pension Could Mean For You

If the proposed minimum pension of ₹5,500 is approved, it could have several positive effects for eligible members:

- Better Monthly Cash Flow

Pensioners who currently receive ₹1,000 would see a significant rise in their monthly income. This can help them manage essential expenses more comfortably. - Improved Retirement Planning

Current employees nearing retirement can plan their finances better if they know that a higher minimum pension is likely. - More Confidence In Social Security

A meaningful increase in pension signals that the government is serious about strengthening social security for private sector employees. - Support For Low Income Pensioners

The largest benefit will be for those who fall in the lowest pension bracket and depend heavily on EPS for daily living expenses.

However, until a formal notification is issued, employees should treat these developments as a possible update rather than a confirmed change.

Official Website For EPFO And EPS Updates

For any confirmed information regarding pension hikes, interest credits, EPF passbook details or EPS rules, employees should rely on the official EPFO website:

Official EPFO Website: https://www.epfindia.gov.in

All important circulars, press releases and notifications are published on this portal. Employees can also check their PF balance, download passbooks and track claim status through the official channels.

Frequently Asked Questions

1. What is the current minimum pension under the Employees Pension Scheme?

At present, the minimum pension under EPS is ₹1,000 per month. This amount was last revised in 2014 and has not been increased since then.

2. Is the pension definitely going to increase to ₹5,500 per month?

As of now, the increase to ₹5,500 is under discussion and has been widely reported as a proposal. The final decision will depend on the central government and the Central Board of Trustees. No official notification has been issued yet.

3. How many pensioners are expected to benefit from the proposed hike?

Approximately 7.8 million pensioners currently receive pension under the Employees Pension Scheme. If the minimum pension is revised upward, a large share of these beneficiaries, especially those receiving the minimum amount, will gain.

4. Who is eligible to receive pension from EPFO under EPS?

Employees who have been members of EPFO and EPS and have completed the required service period become eligible for pension, usually after reaching 58 years of age. They must have contributed to the scheme through their employer during their working years.

5. Where can I check official updates on EPF interest rates and EPS pension changes?

You can visit the official EPFO website at https://www.epfindia.gov.in. All official announcements about interest rates, pension changes, rules and procedures are published there, along with related circulars and notifications.